|

| Please click on Image to Enlarge |

Monday, 20 August 2018

Wednesday, 25 July 2018

China Tower IPO Public Offer

China Tower is seeking for an USD 8.7 billion IPO in Hong Kong, the biggest globally in four years. It is expected to debut on the Hong Kong exchange on 8 August 2018, with pricing of each IPO share slated to be out on 1 August 2018. 43.1 billion shares will be offered globally at a range of HKD 1.26 to HKD 1.58 (USD 0.16 to USD 0.20) for each share.

China Tower is the world’s largest telecommunications tower infrastructure service provider. In 2017, China Tower was ranked first amongst the global telecommunications tower infrastructure service providers in terms of the number of sites, number of tenants and revenue. At end-2018, China Tower’s sites were spread across 31 out of 34 provinces in China; with a market share of approximately 96.3% in terms of the number of sites, and 97.3% in terms of revenue.

China Tower generates its revenue mainly from its tower business and Distributed Antenna System (DAS) business. During 2015 - 2017, a substantial amount of operating revenue was generated from China’s Big Three Telecommunications Service Providers - China Mobile, China Unicom and China Telecom; with operating revenue increasing by 22.6% from RMB 55,997 million in 2016 to RMB 68,665 million in 2017. Operating profit margin grew from 9.1% in 2016 to 11.2% in 2017.

How to apply for the China Tower IPO?

Customers will be able to subscribe to the IPO public tranche if they fulfil the following criteria:

· Minimum subscription of SGD200k (minimum size of 800,000 shares for this China Tower IPO application)

· Customers must sign the irrevocable form.

Please contact me at 90400848 or email to lionellimtp@phillip.com.sg if you are interested.

Tuesday, 24 July 2018

Complimentary Live Quotes!

To empower customers to trade online, as well as to provide a more holistic platform for frequent traders, we have extended our Complimentary Live Price Quotes* promotion for customers, while expanding the number of markets which offers Live Price Quotes. Markets that have Complimentary Live Price Quotes include:

United States |

Hong Kong

|

Japan

|

Malaysia

| |

NASDAQ

NYSE

NYSE-MKT

|

Hong Kong Pre-IPO**

|

TSE

|

BURSA

|

Thailand

SET |

Please contact me at 90400848 or email to lionellimtp@phillip.com.sg to know more and for account opening.

HONG KONG PRE-IPO TRADIING

The Hong Kong Pre-IPO trading market is a channel provided by Phillip Securities for customers to trade Hong Kong shares one day before their official listing in the Hong Kong Exchange. Phillip Securities is the first broking house in Singapore and Hong Kong to offer customers the Pre-IPO trading channel.

The performance of stocks in the Pre-IPO trading session should not be considered as an indicator of its price and demand in the official trading session.

Please contact me at 90400848 or email to me at lionellimtp@phillip.com.sg to know more and for account opening.

Sunday, 22 July 2018

Receive S$38* Cash Credit when you make a purchase contract in the Japan market!

Receive SGD38* Cash Credit when you make a purchase contract in the Japan market during the period of 1 Jun – 31 Aug 2018!

*Customers have to be subscribed to Japan Live Price at point of purchase. Other T&Cs Apply.

Trade in the Japan Market

Find out more!

Real-time Information

Complimentary LIVE price on our platforms!

Japan Strategy Reports

Gain insights about the Japan marke

Tuesday, 19 June 2018

My Greatest Fear: Currency War

The worst thing that I think can happen during the Trade War is the decision by China to devalue its currency.

The last time it happen in 2015 and 2016, the world stock market took a plunge.

China is our major trading partner, and since RMB is devalued, companies earning RMB will earn less relative to SGD.

Asian exports to China will become more expensive. Hence Asian goods and services will become less competitive.

This explains why the market plunge in 2015 and 2016.

Can this lead to a Recession? I really don't know. It's too early to tell.

My view is to Trade and Invest with Caution.

My view is to Trade and Invest with Caution.

Sunday, 17 June 2018

STI broke below 2018 Low of 3338

Dear Clients,

As reported in the news over the weekend, China announces retaliatory tariffs on US$34 billion worth of US goods. This could be the start of an impending global trade war.

Trade war, together with the recent interest hikes by Fed and any further rise in oil prices is likely to slow down economic growth.

Since the start of 2018, the STI Index has been struggling to break out convincingly. Each correction after an attempted rally failed to achieve higher highs. Hence for the last 6 months, the STI has been largely range bound between 3330-3640.

However, the STI has just broken below key support level of 3350 and hit below 2018 low of 3338 this morning. The next immediate support level and key support level is around 3270 and 3200. (Please see chart below).

Are we be witnessing a major correction? If the trade war escalates further, it maybe the start of a bear market.

As reported in the news over the weekend, China announces retaliatory tariffs on US$34 billion worth of US goods. This could be the start of an impending global trade war.

Trade war, together with the recent interest hikes by Fed and any further rise in oil prices is likely to slow down economic growth.

Since the start of 2018, the STI Index has been struggling to break out convincingly. Each correction after an attempted rally failed to achieve higher highs. Hence for the last 6 months, the STI has been largely range bound between 3330-3640.

However, the STI has just broken below key support level of 3350 and hit below 2018 low of 3338 this morning. The next immediate support level and key support level is around 3270 and 3200. (Please see chart below).

Are we be witnessing a major correction? If the trade war escalates further, it maybe the start of a bear market.

|

| STI Chart 15.6.2018. Click to Enlarge. |

Saturday, 16 June 2018

Begin With Junior Sharebuilders Plan and enjoy 12-months handling fee rebates!

Junior Share Builders Plan

Every child is a precious gift to us and we want the best for them. Open a Junior Share Builders Plan jointly with your child to give them a head start in life. You can start up with as low as S$100 a month with any counters that are available in Share Builders Plan.

If you are interested, please contact me at 90400848 or email to me at lionellimtp@phillip.com.sg.

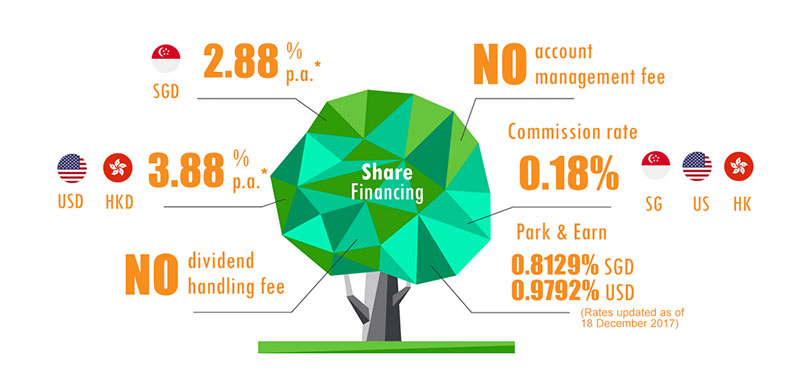

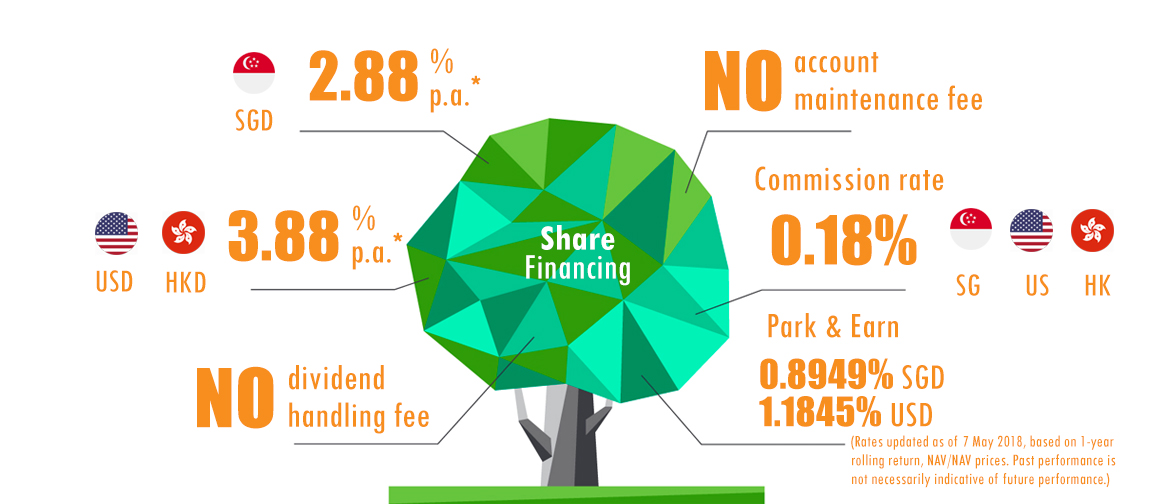

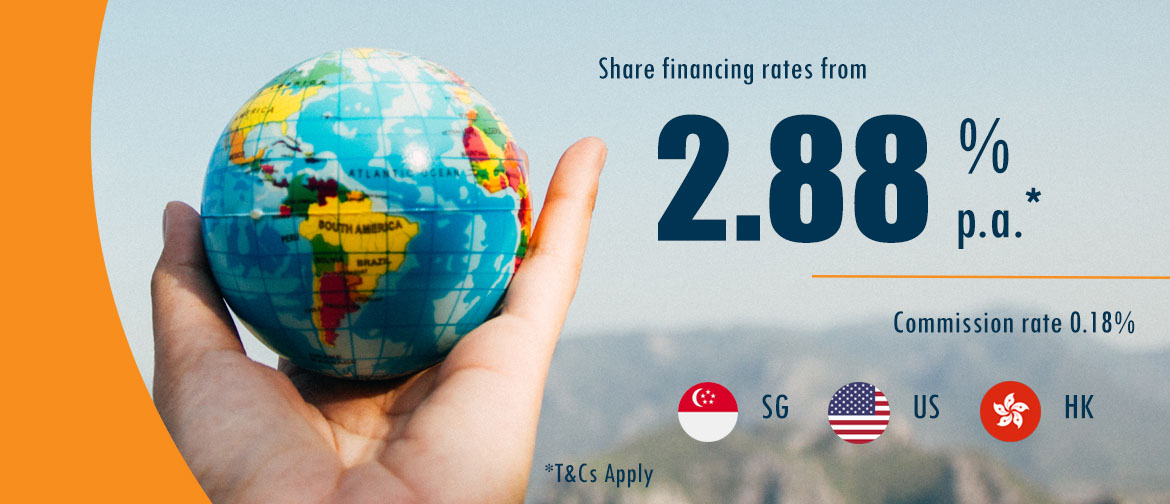

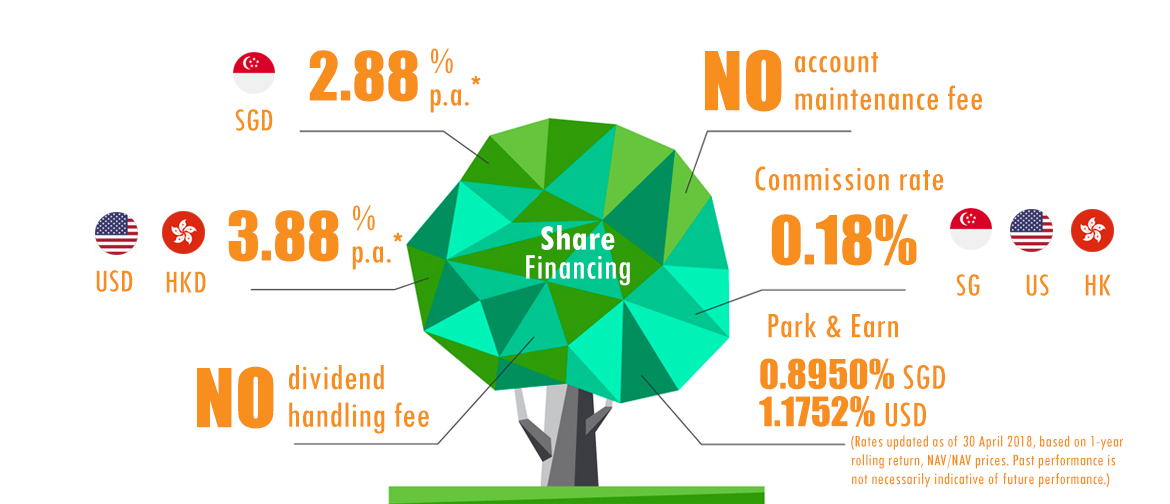

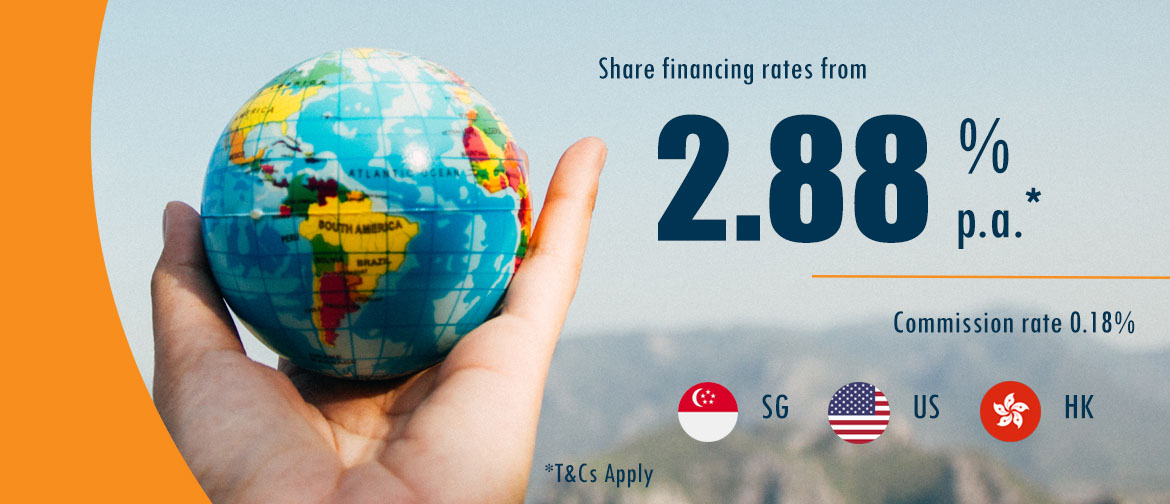

Share Financing Rates from 2.88% per annum

Let your assets work harder for you!

Transfer your cash or shares to your newly opened Phillip Investment Account – Margin (M) to enjoy exclusive rates*:

Please contact me at 90400848 or email to me at lionellimtp@phillip.com.sg to know more.

Trade In The Japan Market And Get SGD38*

Receive SGD38* Cash Credit when you make a purchase contract in the Japan market during the period of 1 Jun – 31 Aug 2018!

*Customers have to be subscribed to Japan Live Price at point of purchase. Other T&Cs Apply.

Trade in the Japan Market

Find out more!

Real-time Information

Complimentary LIVE price on our platforms!

Japan Strategy Reports

Gain insights about the Japan market!

Wednesday, 16 May 2018

Share Financing Rates at 2.88% per annum!

Let your assets work harder for you!

Transfer your cash or shares to your newly opened Phillip Investment Account – Margin (M) to enjoy exclusive rates*:

Please contact me at 90400848 if you wish to know more.

Think Big Start Small! Begin with Regular Savings Plan!

Regular Savings Plan (RSP) is an investment plan that offers a consistent and disciplined means of investment that provides access to stocks and unit trusts with low cost on a monthly basis.

In Phillip, we offer a regular fixed-dollar amount investment plan which enables you to buy shares or unit trusts. By investing a fixed amount of funds consistently every month over a period of time, you will eventually buy more units when prices are low and less units when prices are high. This investment method is known as dollar-cost averaging, and it is especially useful in hedging against market volatility where it lessens the risk of investing a large amount in a single investment.

Begin with

Regular Savings Plan

Regular Savings Plan

For more information, please contact me at 90400848.

Thursday, 5 April 2018

Is it the Right Time to Buy? or to Sell?

Dear Investors, Traders and Clients

There is a chance that the Trade Tariffs imposed by US Government against China may erupt into a Trade War. China is likely to retaliate further.

Will other countries have the guts to join in and result in a Global Trade War?

We will have to watch and see what happens as the events unfold.

The Global Markets have came down as a result of the Risk of the Trade War and have entered into a Short Term Oversold Position.

The Million Dollar Question is whether is this a Temporary Sell Off or will it decline further.

Hence I have identified the Potential Next Support Level for the STI is around 3200 Level, if the Situation above gets Worse.

Please click on the Image below, to see an Enlarged Version of the STI Chart.

There is a chance that the Trade Tariffs imposed by US Government against China may erupt into a Trade War. China is likely to retaliate further.

Will other countries have the guts to join in and result in a Global Trade War?

We will have to watch and see what happens as the events unfold.

The Global Markets have came down as a result of the Risk of the Trade War and have entered into a Short Term Oversold Position.

The Million Dollar Question is whether is this a Temporary Sell Off or will it decline further.

Hence I have identified the Potential Next Support Level for the STI is around 3200 Level, if the Situation above gets Worse.

Please click on the Image below, to see an Enlarged Version of the STI Chart.

Wednesday, 4 April 2018

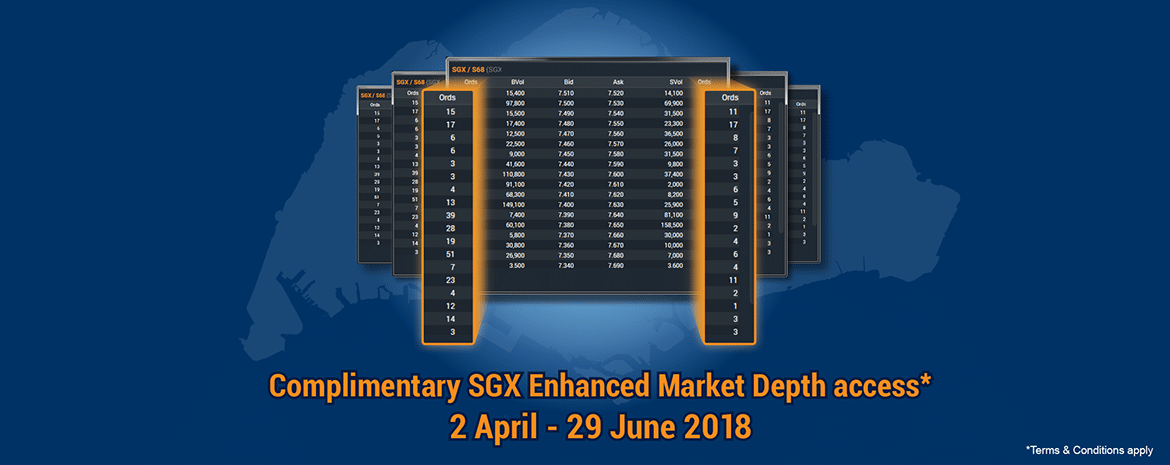

Complimentary SGX Enhanced Market Depth Access

Did you know the Straits Times Index (STI) rose to its highest level in over 10 years in January this year? To help you to capitalise on opportunities in the Singapore market, we are offering complimentary SGX Enhanced Market Depth Access from 2 April to 29 June 2018.

SGX Market Depth, also known as Level 2 Market Data displays the number of Buy orders and Sell orders of each price level of a particular listed security (e.g. stocks or ETFs), up to 20 levels of pending orders on both Buy and Sell side. In simple terms, it shows the different price levels which buyers are willing to buy and sellers willing to sell at any given time.

SGX Market Depth is in real time and the orders shown changes constantly from pre-open session to market close. SGX Market Depth information allows you to enhance trading decisions by checking stock liquidity, optimising buy / sell orders, and establishing price support / resistance.

For a limited time only, you will get complimentary SGX Market Depth Access on all POEMS suite of trading platforms i.e. POEMS 2.0, POEMS Mobile 2.0 and POEMS Mercury. SGX Enhanced Market Depth is available only on POEMS 2.0 and POEMS Mercury. No subscription required!

Not sure how to use SGX Market Depth? Here is a guide to help you:

Saturday, 24 March 2018

Market Update: Dow drops more than 400 points into correction.

My View: The markets are likely to have further selling this week. There could be margin calls and force selling as well. If a trade war erupts, the inflation is likely to rise faster resulting in quicker rate hike, thereby preventing the equity markets to rise. Please trade and invest cautiously as the events unfold.

https://lionelltp.blogspot.sg/p/disclaimer.html

Dow drops more than 400 points into correction, posts worst week since Jan. 2016

- The major averages posted their biggest weekly loss since January 2016.

- The Dow and S&P 500 dropped 5.7 percent and 5.9 percent this week, respectively, while the Nasdaq pulled back 6.5 percent.

- "The market has been priced for perfection ... and that leaves the market vulnerable to surprises. In this case, it's trade," notes one strategist.

Stocks fell sharply on Friday, adding to their steep weekly losses, as investors assessed the possibility of a trade war brewing between the U.S. and China.

The Dow Jones industrial average dropped 424.69 points to close at 23,533.20 — its lowest level since November — with DowDuPont as the worst-performing stock. The 30-stock index also closed in correction, down 11.6 percent from its 52-week high.

The S&P 500 declined 2.1 percent to 2,588.26, with financials pulling back 3 percent. It also closed just outside correction territory. The Nasdaq composite fell 2.4 percent to 6,992.67. The indexes, along with the Dow, had traded higher earlier in the session.

Tuesday, 20 February 2018

Receive SGD68 When You Buy Malaysia Stocks!

From 19 Feb – 30 Apr 2018, receive SGD68 cash credit for every MYR250,000 BURSA Malaysia stocks purchased. Login to start trading!

Limited redemptions available!

- Terms & Conditions for SGD 68 Cash Credit

- This promotion is strictly applicable for trades executed with Phillip Investment Accounts — Prepaid (CC), Cash Management (KC), Custodian (C), Margin(M) and Phillip Financial (V) — for the promotional period of 19th February till 30th April 2018. Not applicable for Cash, Corporate and Managed accounts.

- SGD68 Cash Credit will be distributed to customers for every MYR250,000 worth of BURSA Malaysia equity contracts bought.

- Customers must make all buy transactions for BURSA Malaysia equity contracts that totals up to MYR250,000 under the same account to be eligible for the incentive. There is no limit to the number of buy transactions that customers may make.

- The amount stated is based on the buy contract gross proceeds, excluding ALL other charges and taxes incurred like commission charges and GST.

- Limited redemptions available, based on a first come first serve basis.

- Incentive is redeemable up to a maximum of 3 times per account.

- Cash credit will be credited into customer’s account by 31st May 2018.

- The following persons are not eligible to participate in this promotion unless approved by the management of Phillip Securities Pte Ltd (PSPL):

- Phillip Securities Pte Ltd (PSPL) institutional clients and corporate clients

- Phillip Securities Pte Ltd (PSPL) account holders whose accounts have been suspended, cancelled or terminated.

- In the event of a dispute over the client’s eligibility to participate in this promotion, Phillip Securities Private Limited’s (“PSPL”) decision will be final.

- PSPL reserves the rights to amend, add or remove the Terms & Conditions of this promotion without prior notice.

- All employees of Phillip Securities Pte Ltd (PSPL) and its associated entities (e.g. Trading Representatives, Financial Advisors); PSPL and all its subsidiaries (direct or indirect) are not eligible for this promotion.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and / or delete these Terms and Conditions without prior notification (including eligibility; replace the prize of similar value; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and / or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason there of and without any compensation or payment whatsoever. PSPL decision on all matters relating to the promotion shall be final and binding on all participants.

- By taking part in this promotion, the participant acknowledges that he/she has read and consented to these Terms & Conditions.

POEMS ChartWhiz: Trade Ideas from POEMS 2.0

June 5, 2017 | Posted by Honghui Lin

With immediate effect, we have made POEMS ChartWhiz available free-of-charge to all POEMS clients. No fees, no subscription required.

Powered by Recognia’s Technical Insights tool, POEMS ChartWhiz gives you access to technical analysis and fundamental strategies to provide you with actionable trade ideas, idea validation and risk management to complement your trading. With easy-to-use premium analytics tools that caters to both novice and experienced investors, you will be able to shortlist trade ideas and turn them into trading opportunities with minimal effort.

With thousands of financial instruments to choose from, finding relevant trade opportunities can be a challenge. But with POEMS ChartWhiz, you get unbiased, unique, technical and fundamental analysis that will help in your investment and trading decisions. With POEMS ChartWhiz, you can easily navigate to quickly find trade ideas, validate recent trade opportunities and automatically monitor your stocks.

Getting to POEMS ChartWhiz

Method 1: Add ChartWhiz widget

- Click the +New icon to add a new tab

- On the right navigation menu, select ‘Stock’

- Click the ‘ChartWhiz’ widget to add the new workspace

- Read and agree to the disclaimer

Method 2: Right click on counter

- In the LP1 (Price) or LP2 (Trade) tabs, right click on your preferred counter

- Select ChartWhiz

- A new pop-up window will appear

- Read and agree to the disclaimer

Featured Ideas

From the main landing page, you will see the module ‘Featured Ideas’. Every day, POEMS ChartWhiz automatically identifies up to 10 bullish and bearish stocks with interesting developments based on technical and fundamental analysis and back-tested strategies. Each stock has a dashboard with educational commentary that details why the stock was selected.

Tuesday, 16 January 2018

Receive $30 Cash Credit When You Subscribe to an RSP*

Happy New Year To You!

It’s the time of the year to set resolutions and goals as we welcome a brand new start. Some of you may be wondering how to grow your wealth, while others are wondering how they should use their Chinese New Year red packet money. Why not start with an investment plan that encourages regular, bite-size investments to save for the new year?

Did you know…?

Investing in Unit Trusts and through a Regular Savings Plan (RSP) does not have a lock-in period, as compared to other regular investment facilities that may have a lock-in period of 10, 20 years.Whether you want to purchase that dream car or house, pay for your children’s education or go on that holiday that you have been looking forward to, you have the freedom to redeem your holdings.

Understanding Regular Savings Plan (RSP)

Plan your investment on solid ground

Whether you are planning for retirement, saving for your children, or achieving financial goals, a sound investment plan and the right products are your winning formula. In this scheme, the high potential returns and cost effectiveness of Unit Trusts are combined with an investment strategy. The scheme is known as the Regular Savings Plan or RSP for short.

RSP builds your Unit Trust portfolio over time by an investment strategy called Dollar Cost Averaging, which mitigates market risks and fluctuations.

It is difficult to time the market where the prices fluctuate all the time. Adopting dollar cost averaging is an investment strategy to ensure an overall risk-mitigated average price per share.

For limited Period,

Receive S$30 cash credits when you subscribe to an RSP.*

Receive up to S$30 cash credits when you subscribe to an RSP for any of the promotion funds:

- Phillip Singapore Real Estate Income Fund

- Phillip Income Fund

- Phillip Asia Pacific Growth Fund

3 Easy Steps to subscribe to RSP

- Step 1: Login to POEMS

- Step 2: Click “Acct Mgmt” (Account Management tab) > “Regular Savings Plan

- (RSP)”

- Step 3: Search for fund and apply for RSP

- A minimum monthly RSP subscription of $200 or quarterly RSP subscription of

- $600 is required to qualify for this promotion.

Receive these rewards for a limited period!

Promotion runs from 8 January to 9 March 2018. Ready to invest?

Opt in for Phillip’s Excess Funds Facility

Excess Funds Facility. Clients must thus opt in to the parking facility to

be eligible for the promotion.

About Phillip’s Excess Funds Facility

The excess funds facility manages your idle cash into a money market fund.

Let us help you maximize your investment opportunities!

Let us help you maximize your investment opportunities!

- Fast and simple online transfer & withdrawal

- No sales charge or administrative fees

- No lock-in period

- The largest^ retail SGD Money Market Fund in the market

^Based on Total Net Assets (TNA) figures reflected in FundSingapore.com

Interest earned:

SGD

0.8378% p.a.

USD

1.0166% p.a.

Rates updated as of 15 January 2018, based on 1-year rolling return,

NAV/NAV prices.

Past performance is not necessarily indicative of future performance.

NAV/NAV prices.

Past performance is not necessarily indicative of future performance.

More about money market fund

Sunday, 14 January 2018

Enjoy 0.12% or $10 minimum commission

Enjoy 0.12%* or S$10 minimum commission for online trades in Singapore listed stocks!

Extended till 30th June 2018

Want to get started on buying stocks and shares? Here are some tips on how to decide which brokerage firm to start on your investment journey!

Please contact me at 90400848 or email to me at lionellimtp@phillip.com.sg to know more.

Thursday, 11 January 2018

Gain More Insights with SGX Enhanced Market Depth on Poems 2.0

We are pleased to inform you that we have added 2 additional columns (Ords) to SGX Market Depth on POEMS 2.0. Ords denote the number of buy or sell orders that totaled up the volume at each price level. At one glance, you can determine from your order book whether the market action is being driven by retail investors or institutions. With SGX Enhanced Market Depth, you can now gain an edge in trading and help you make more informed trading decisions.

No SGX Market Depth? Subscribe with POEMS Reward Points today.

Getting to SGX Market Depth

Method 1: Add Trading Info widget

Method 2: Right click on counter

1. LP1 (Price) or LP2 (Trade) tabs, right click on your preferred SGX counter

2. Select Market Depth

3. A new pop-up window will appear

If you have any further questions, please contact me at 90400848 or email to me at lionellimtp@phillip.com.sg.

|

Wednesday, 3 January 2018

For New Clients Get Trade Rebates Up to $88 for the first 3 Trades!

Try out the new suite of POEMS trading platforms and

get trade rebates of up to $88 for the first 3 trades!

Follow the simples steps below to get your trade rebates

STEP 1:

Open a Phillip Account

(Contact Me at 90400848 or lionellimtp@phillip.com.sg)

STEP 2:

Trade via POEMS 2.0, POEMS Mobile 2.0 or POEMS Mercury for SGX, US and HK markets

STEP 3:

Receive your trade rebates!

Promotion Ending on 30 March 2018! Terms and Conditions Apply. Please contact me to find out more.

Tuesday, 2 January 2018

Promotion: Enjoy Share Financing Rates from 2.88% p.a.

Let your assets work harder for you!

Transfer your cash or shares to your newly opened Phillip Investment Account – Margin (M) to enjoy exclusive rates*:

Why Phillip Investment account – Margin (M)?

- Up to 70% financing for over

- 2000 stocks across 11 international markets

- 70 bonds

- 200 unit trusts

More facilities available with Phillip Investment Accounts

Please contact me at 90400848 or email to me at lionellimtp@phillip.com.sg to know more.

Subscribe to:

Comments (Atom)