Dear Investors, Traders and Clients

There is a chance that the Trade Tariffs imposed by US Government against China may erupt into a Trade War. China is likely to retaliate further.

Will other countries have the guts to join in and result in a Global Trade War?

We will have to watch and see what happens as the events unfold.

The Global Markets have came down as a result of the Risk of the Trade War and have entered into a Short Term Oversold Position.

The Million Dollar Question is whether is this a Temporary Sell Off or will it decline further.

Hence I have identified the Potential Next Support Level for the STI is around 3200 Level, if the Situation above gets Worse.

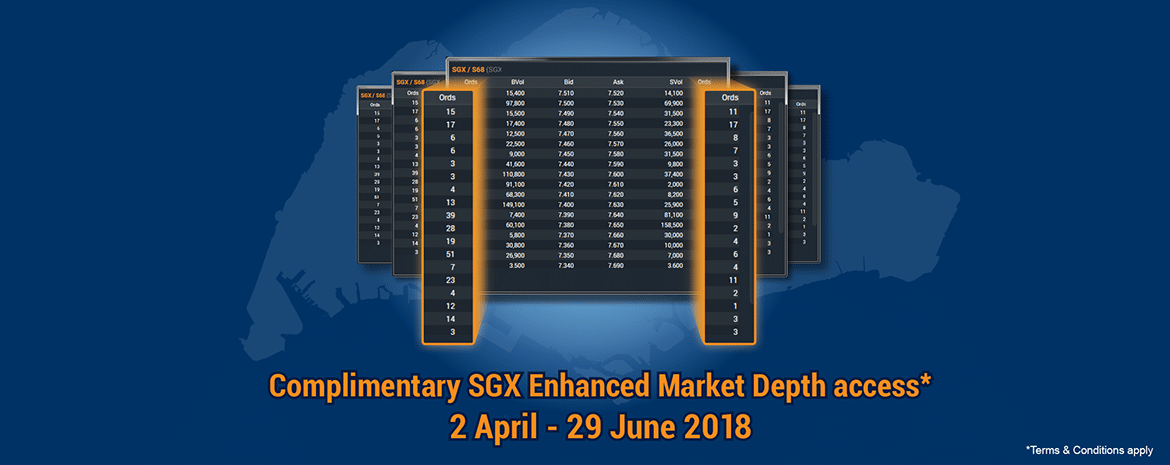

Please click on the Image below, to see an Enlarged Version of the STI Chart.