Happy New Year To You!

It’s the time of the year to set resolutions and goals as we welcome a brand new start. Some of you may be wondering how to grow your wealth, while others are wondering how they should use their Chinese New Year red packet money. Why not start with an investment plan that encourages regular, bite-size investments to save for the new year?

Did you know…?

Investing in Unit Trusts and through a Regular Savings Plan (RSP) does not have a lock-in period, as compared to other regular investment facilities that may have a lock-in period of 10, 20 years.Whether you want to purchase that dream car or house, pay for your children’s education or go on that holiday that you have been looking forward to, you have the freedom to redeem your holdings.

Understanding Regular Savings Plan (RSP)

Plan your investment on solid ground

Whether you are planning for retirement, saving for your children, or achieving financial goals, a sound investment plan and the right products are your winning formula. In this scheme, the high potential returns and cost effectiveness of Unit Trusts are combined with an investment strategy. The scheme is known as the Regular Savings Plan or RSP for short.

RSP builds your Unit Trust portfolio over time by an investment strategy called Dollar Cost Averaging, which mitigates market risks and fluctuations.

It is difficult to time the market where the prices fluctuate all the time. Adopting dollar cost averaging is an investment strategy to ensure an overall risk-mitigated average price per share.

For limited Period,

Receive S$30 cash credits when you subscribe to an RSP.*

Receive up to S$30 cash credits when you subscribe to an RSP for any of the promotion funds:

- Phillip Singapore Real Estate Income Fund

- Phillip Income Fund

- Phillip Asia Pacific Growth Fund

3 Easy Steps to subscribe to RSP

- Step 1: Login to POEMS

- Step 2: Click “Acct Mgmt” (Account Management tab) > “Regular Savings Plan

- (RSP)”

- Step 3: Search for fund and apply for RSP

- A minimum monthly RSP subscription of $200 or quarterly RSP subscription of

- $600 is required to qualify for this promotion.

Receive these rewards for a limited period!

Promotion runs from 8 January to 9 March 2018. Ready to invest?

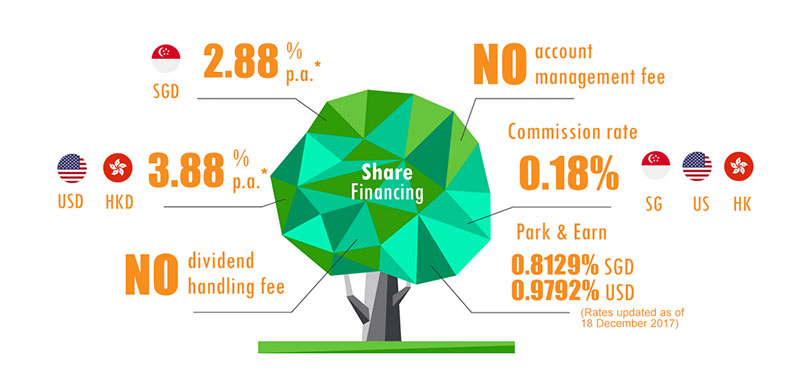

Opt in for Phillip’s Excess Funds Facility

Excess Funds Facility. Clients must thus opt in to the parking facility to

be eligible for the promotion.

About Phillip’s Excess Funds Facility

The excess funds facility manages your idle cash into a money market fund.

Let us help you maximize your investment opportunities!

Let us help you maximize your investment opportunities!

- Fast and simple online transfer & withdrawal

- No sales charge or administrative fees

- No lock-in period

- The largest^ retail SGD Money Market Fund in the market

^Based on Total Net Assets (TNA) figures reflected in FundSingapore.com

Interest earned:

SGD

0.8378% p.a.

USD

1.0166% p.a.

Rates updated as of 15 January 2018, based on 1-year rolling return,

NAV/NAV prices.

Past performance is not necessarily indicative of future performance.

NAV/NAV prices.

Past performance is not necessarily indicative of future performance.

More about money market fund